CREATED OPPORTUNITIES

CAPITAL | DEVELOPMENT | ADVISORY

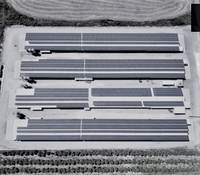

PV ROOFTOP PORTFOLIO

CAPITAL | Structuring of "warehousing" senior debt financing with regard to a portfolio of rooftop installations in Israel. Indigo represented Kommunalkredit Austria AG as senior lender of the construction bridge finance for more than 100 PV installations and placed the financing to Phoenix Insurance company converting the EUR loan into long term NIS denominated financing.

KEY FEATURES | Asset Class: Photovoltaic | Country: Israel | Volume: EUR 65m | Size: 85 MW

SPONSOR | Solaer Israel Ltd.

50 MW ALIZARSUN PV PROJECT

DEVELOPMENT | We raised equity, senior and mezzanine debt for a 50MW PV Project in Zaragoza Spain and lead the commercial development of the transaction - from negotiation of a long-term power purchase agreement to EPC & O&M Contracts, from financial model supervision to insurance due diligence. Above all, Indigo assumed a key role in managing the interface of the development towards a successful financial close

KEY FEATURES | Asset Class: Photovoltaic | Country: Spain | Volume: EUR 35m | Size: 50 MW

CLIENT | Alizarsun, S.L.

IPO OF SOLAER RENEWABLE ENERGIES

ADVISORY | We advised the client on the restructuring of its corporate financing and supported the company in the initial public offering process.

KEY FEATURES | Country: Israel | Asset Class: Renewable Energy | Country: Israel | Volume: EUR 150m |

CLIENT Solaer Renewable Energies Ltd

450MW MRC ALON TAVOR IPP

CAPITAL | We represented Kommunalkredit Austria AG with regard to a EUR denominated senior debt facility for the acquisition of the first power plant privatized by state owned Israel Electric Corporation.

KEY FEATURES | COUNTRY: Israel | ASSET CLASS: Combinded Cycle / Open Cycle Gas Power Plant | SIZE: 430 MW | VOLUME: not disclosed

SPONSORS | China Harbour | Rapac Energy | Mivtah Shamir